- October 25, 2021

- Posted by: Sabre Partners

- Category: Uncategorized

This article was originally posted on https://www.livemint.com/companies/news/aviom-india-housing-finance-raises-8-million-from-sabre-partners-11634550581329.html

The company is expected to use the proceeds from the current raise to further expand and grow its operations

BENGALURU : Housing finance company, Aviom India Housing Finance, on Monday said it has raised $8 million as a part of its Series C equity financing from Sabre Partners.

The company is expected to use the proceeds from the current raise to further expand and grow its operations.

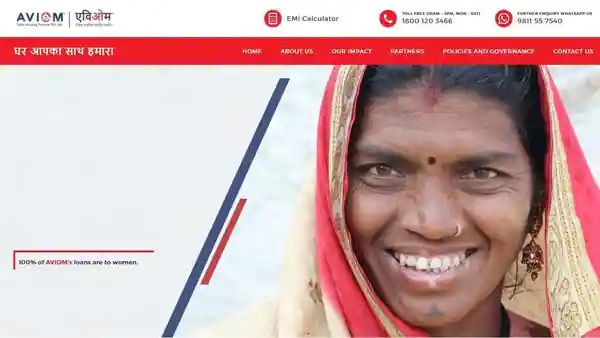

The five-year-old company caters to low-income households in rural and semi-urban areas. It provides loans to women borrowers who do not have any formal income documentation. These loans are usually for construction, improvement, sanitation and renovation. It also gives loans against property for business requirements.

“We are excited to partner with such pedigreed investors and shall be using the funds to expand our footprint and grow the business further,” said Kajal Ilmi, founder, Aviom.

Loan ticket size on the platform ranges from ₹50,000 to ₹5 lakh with average credit disbursement touching ₹3 lakh. Currently, the housing finance entity has a presence in 14 states with over 100 branches.

The company also provides livelihood to more than 18,000 women through its Shakti Channel which incentives them to source loans in rural areas, Aviom said. It claims that its digital lending platform helps in increasing operational efficiency and reducing turn-around time thereby ensuring effective credit decision making.

The company has raised debt financing from more than 40 lenders, including public and private sector banks, global development finance institutions and domestic financial investors.

Aviom’s top lenders include Northern Arc, NHB, MAS Financials, Black Soil, IDFC First Bank, Jana small finance bank, Water Equity, DFC, IndusInd Bank, State Bank of India (SBI) and AU small finance bank, among others.

The company is now aiming to take its gross loan portfolio to ₹1,000 crore by the end of financial year 2022. Its gross loan portfolio stood at ₹465 crore as of March, this year.